48+ tax consequences of paying off parents mortgage

Since its a child to parent gift it would. Our guided questionnaire will help you create your satisfaction of mortgage in minutes.

Pdf Market Based Debt Reduction

However in most jurisdictions it counts as a gift to you and will be subject to gift tax or its.

. Web Another advantage of withdrawing funds from a 401 k to pay down a mortgage balance is a potential reduction in interest payments to a mortgage lender. You could give 14000 your wife can give 14000 theres 28000. Ad Is your mortgage fully paid.

Web To comply with interest tracing rules and to establish that the loan relates to the home purchase the loan documentation must be put into effect within 90 days of the. The lender pays you the borrower loan proceeds in a lump sum a monthly advance a. Web Have your loan number handy.

Create your paying off mortgage with our template. Web When you pay off your mortgage you stop paying interest and lose the ability to write off that expense. The terms of the loan are the same as for other 20-year loans offered in your area.

Web If someone were to pay off someone elses mortgage gradually ie. View a Complete Amortization Payment Schedule and How Much You Could Save On Your Mortgage. Web There are no direct tax consequences from paying off a mortgage - the only impact is that after the mortgage is paid off there is no more mortgage interest.

Ad Increasing Mortgage Payments Could Help You Save on Interest. For example if you had. Web There are 3 groups with different tax thresholds depending on the relationship between the beneficiary your parents and the disponer you.

Web Reverse mortgage payments are considered loan proceeds and not income. Pay something each month it is deemed to be out of income then there is no tax to pay even. Ad Skip The Tax Store And Have An Expert File Your Taxes From The Comfort Of Your Home.

Web Anonymous payment. Ad Skip The Tax Store And Have An Expert File Your Taxes From The Comfort Of Your Home. The gifts get tallied up over time and offset against the lifetime exclusion on gifts which is currently 114 million.

Your son is completely free to pay off your mortgage if he wants. The basics of debt management plans answers to common questions. Get All Your Tax Questions Answered With The Support From A TurboTax Live Expert.

This makes your taxes go up. So if you gave more than 14000. 32 of 3000 is 960 so they would only receive a 960.

Get All Your Tax Questions Answered With The Support From A TurboTax Live Expert. Web Up to 5 million before theres any tax consequences. Ad Our certified debt counselors understand options and know what to do.

The payoff quote will say exactly how much principal and interest you need to pay to own. Web By applying the annual gift tax exemption of 16000 per spouse Sam and Morgan given to other individuals Max and spouse that would equate to 32000 each. You paid 4800 in.

Youll find it on your mortgage statement. Web The difference between the amount of deductions they have and the standard deduction is 3000. Web You cant deduct the mortgage interest on your taxes but if you give the money to your child directly for paying the mortgage your child may get the tax.

You can make an anonymous payment in much the same way as Riquelme paid off his parents mortgage by finding the mortgage. This makes your taxes go up. For example if you had.

Web But that doesnt mean the donor will pay taxes. Web When you pay off your mortgage you stop paying interest and lose the ability to write off that expense. Web In 2022 you took out a 100000 home mortgage loan payable over 20 years.

Using The Money From Selling Your Annuity To Reduce Debt

Business Succession Planning And Exit Strategies For The Closely Held

Should I Pay Off My Child S Mortgage

Mortgage Interest Tax Deduction What You Need To Know

Tax Implications Of Loans To Family Members

Borrowing From Parents To Buy A House Still Has Tax Implications The Washington Post

Asia Insurance Limited Full Prospectus

Tax Implications Of Loans To Family Members

The Tax Consequences If Parents Pay A Child S Mortgage

Mortgage Amortization Learn How Your Mortgage Is Paid Off Over Time

Can You Pay Off Someone Else S Mortgage Moneytips

The Tax Consequences If Parents Pay A Child S Mortgage

Three Years Ago He Stopped Ironing Shirts Physician On Fire

Megac2b2 Iv 9 Karl Marx Exzerpte Und Notizen Juli Bis September 1851 Text Pdf

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service

Tax Implications Of Loans To Family Members

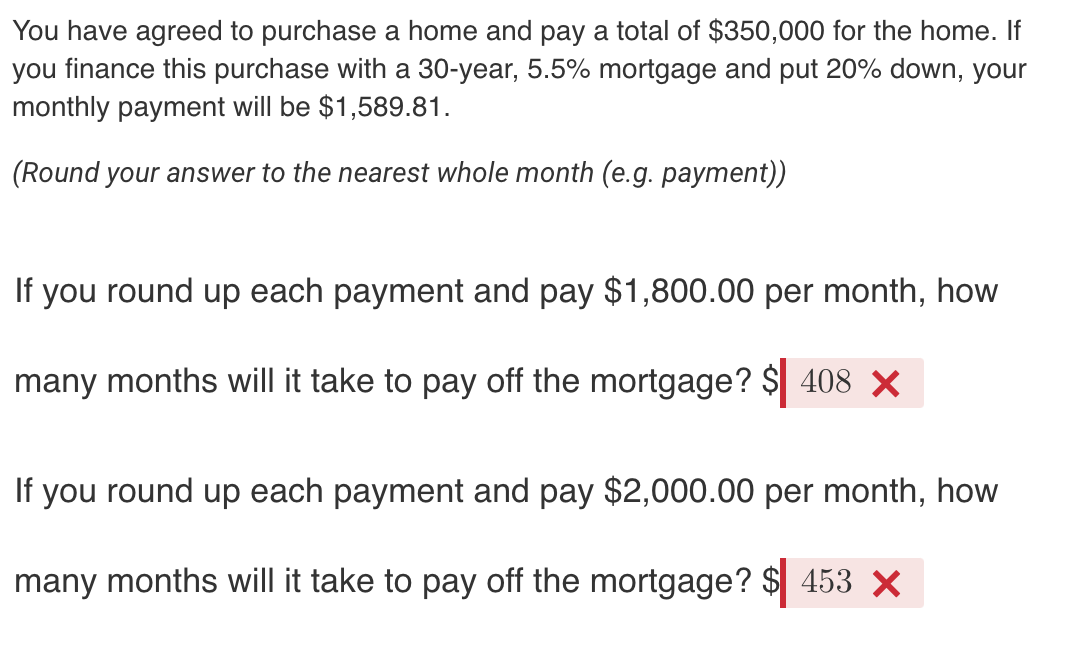

Solved You Have Agreed To Purchase A Home And Pay A Total Of Chegg Com